Navigating Opportunities: February 5th, 2024

- Feb 4, 2024

- 3 min read

Updated: Jan 2

High-Quality Fixed Income – Strongly Overweight duration

At its meeting last week, the Federal Reserve did not raise rates as anticipated. Looking ahead, there is a 38% chance that rates may decrease during the March 20th FOMC meeting and a high probability of nearly 95% that they will fall by 1% or more by the September 18th FOMC meeting, as per the CME's FedWatch tool. This indicates that short-term rates are likely to remain the same or decrease in the next six months, making longer-duration assets more appealing and reducing cash yields. Our perspective is that the Fed could be influenced by the "long and variable lags" problem, which is a known issue related to the data they depend on, despite their "data dependence" policy.

High Yield Fixed Income – Overweight credit

Default rates have risen to 2.88% in December, but are still below the long-run average of 3.54%. We do not expect defaults to rise much in the near term. beyond the long-run average since most companies refinanced their debt to long-term low rates and have limited debt maturities in the next year. It makes sense then that spreads are tight at 3.56%.

Also, delinquency rates, which are seen as a leading indicator of defaults, have risen over the past several quarters but remain very low at 1.32%. We should receive an update to this data in mid-February. We remain overweight given the mix of low default risk, higher yield, and low delinquency rates.

US Equities – Underweight, tilt toward small cap and value

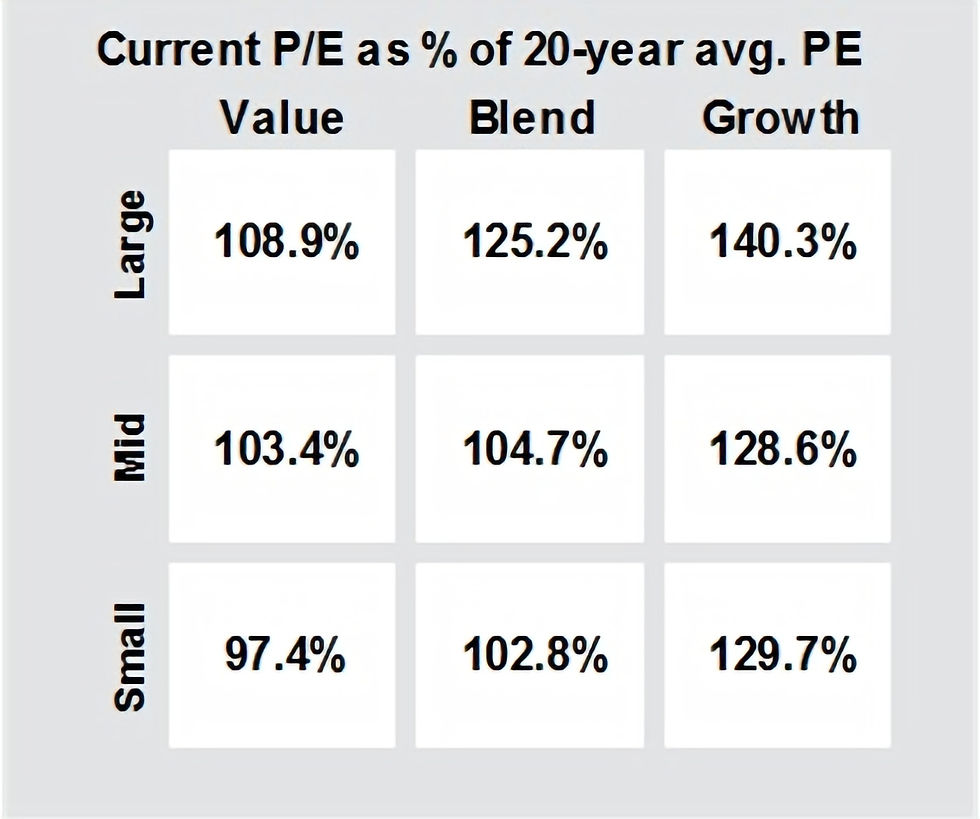

Last week, US stocks gained 2.6% on their march to record highs, driven by strong economic data, such as S&P PMI and Q4 GDP. However, the S&P 500 P/E ratio of 25.6 is above the historical average, implying a high valuation.

Next week may continue to be volatile due to the Fed decision last week, the jobs report, and mega-cap earnings.

International Developed Equities – Overweight, tilt toward Japan

The European stock market, as measured by the MSCI Europe Index, had a negative return of about -1.8% in local currency terms, and about -3.2% in dollar terms in January 2024. The market faced some headwinds from the ongoing war in Eastern Europe, the rising inflation, and the tightening monetary policy by the European Central Bank. However, some sectors, such as financials, utilities, and consumer staples, outperformed the broader market, as they benefited from higher interest rates, stable demand, and dividend yields. Some analysts are cautiously optimistic about the European market for the rest of 2024, expecting some reforms and opportunities. The P/E ratio for the MSCI ACWI ex-US index is 12.9x as of December 31st compared to its 20-year average of 13.1x. This represents a 33.7% discount to the S&P 500 after one corrects for the natural discount of the MSCI ACWI Ex-US to the S&P500.

The Japanese stock market, as measured by the TOPIX index, had a positive return of about 4.5% in local currency terms, and about 2.8% in dollar terms in January 2024. The market was boosted by solid global economic growth, strong demand for high-tech products, and improved corporate earnings and governance. However, the market also faced some challenges, such as rising interest rates, geopolitical risks, and a possible shift in monetary policy by the Bank of Japan. We are bullish on the Japanese stock market for the rest of 2024. Japan appears to be poised to outperform in the years ahead as their P/E is historically low and the government is enacting policies that are likely to raise the profitability of companies. We also believe the US dollar will continue to fall and provide a positive tailwind for non-dollar assets.

Emerging Markets (EM) – Neutral, underweight China, overweight Korea, Mexico, India

Emerging market stocks, as measured by the MSCI Emerging Markets Index, had a positive return of about 7.9% in local currency terms, and about 6.4% in dollar terms in January 2024. The market was supported by the guidance from the Fed that interest rates may begin to decline in 2024, the recovery in earnings growth, and the signs of a bottoming in China’s economic growth. However, the market also faced some challenges, such as geopolitical tensions, rising inflation, and slowing global growth.

The Mexican stock market, as measured by the S&P/BMV IPC index, had a positive return of about 11% in local currency terms, and about 9.2% in dollar terms in January 2024. The market was supported by faster economic growth, nearshoring activity, and solid corporate earnings.