Private Assets: Four Types of Private Investors

- Jun 16, 2025

- 4 min read

Updated: Jan 20

Investors often seek private investments as they believe there to be the potential for substantial returns that surpass those of public markets, all while avoiding the day-to-day fluctuations typical of public market volatility. At Avantia, we have a nuanced view of this. While an investor should demand additional returns to accept the additional risk of illiquidity, lockups, late tax reporting, and other complications involved with private assets, the investor should also be very mindful of taxes and fees which can easily erode the performance difference. However, accessing these opportunities is typically restricted by securities laws designed to safeguard investors who may not possess the financial means to bear the risks associated with unregistered securities. As a result, individuals must meet specific net worth or asset thresholds to qualify for participation in private investment offerings. Among the various investor categories, accreditation, qualification as a qualified client, and status as a qualified purchaser or qualified institutional buyer are commonly required to access private market investments.

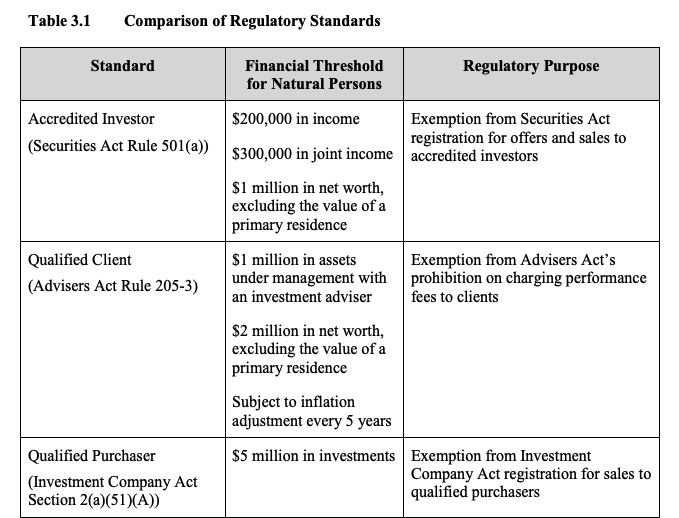

Accredited Investor (AI) — The Entry Point to Private Markets

Individuals or couples with a net worth of at least $1 million (excluding their primary residence) or individuals whose income has exceeded $200,000 (or $300,000 in combination with a spouse) for the past two years and is expected to continue at that level.

Certain institutions such as banks, broker-dealers, and trusts with at least $5 million in assets.

They may invest in 3(c)(1) funds which are limited to only 100 Accredited Investors or 250 under certain circumstances.

Qualified Client (QC) — Extended Access Through Advisor Relationships

Typically individuals with a net worth of at least $2.2 million (excluding their primary residence) and at least $1.1 million under management by an investment advisor following their investment in an applicable fund.

Qualified purchasers automatically qualify as qualified clients.

These thresholds are indexed to inflation and adjusted every five years. The next inflation adjustment will occur in May of 2026.

Qualified Purchaser (QP) — Sophisticated Capital, Broader Opportunities

Individuals or married couples with at least $5 million in investable assets (excluding their primary residence) qualify as qualified purchasers.

Trusts may also qualify under certain conditions, such as having at least $5 million of investable assets or being established for the benefit of qualified purchasers.

They may invest in both 3(c)(1) and 3(c)(7) funds. 3(c)(7) funds are allowed to have as many as 2000 Qualified Purchasers which gives these funds potentially more access to capital and thus a wider array of investment opportunities for the fund.

Qualified Institutional Buyer (QIB) — Institutional Access & Scale

Institutional investors that meet specific criteria outlined by the Securities and Exchange Commission (SEC), allowing participation in certain exempt offerings.

Criteria often include large institutional investors such as banks, insurance companies, pension funds, and investment companies, among others.

To qualify as a QIB in the United States, entities must meet specific financial criteria outlined in Rule 144A under the Securities Act of 1933, including financial institution status and asset size requirements.

Financial Institution Status: The entity must be one of the following: • A registered broker-dealer under the Securities Exchange Act of 1934. • An investment company registered under the Investment Company Act of 1940. • A bank, insurance company, or savings and loan association as defined in the Securities Act. • A trust fund with total assets of at least $5 million, not formed for the specific purpose of acquiring the securities offered.

Asset Size: Entities that are not registered broker-dealers or investment companies, must own and invest on a discretionary basis at least $100 million in securities of non-affiliated issuers.

As we have presented this information, each progressive level of investor has more investment choices. Unfortunately, there is no perfect way to determine an investor's ability to understand the investments that are available to them and we feel that it is vital that an investor understand their investments before engaging in any complex transaction or investment structure.

Conclusion:

In summary, private investments offer unique opportunities for investors to potentially achieve significant returns beyond public markets. However, participation in these opportunities often hinges on meeting specific investor criteria, such as accreditation, qualification as a qualified client, or status as a qualified purchaser. The inclusion of Qualified Institutional Buyers (QIBs) underscores the importance of institutional participation in private markets, adding another layer to the spectrum of eligible investors.

Sources and Disclosures

Qualified Purchasers (QP): Regulation 2(a)(51) of the Investment Company Act of 1940 (U.S.): Defines the term "qualified purchaser." Securities and Exchange Commission (SEC) Rules under the Investment Company Act of 1940: Provides additional guidance on the definition and criteria for qualified purchasers.

Accredited Investors (AI): Regulation D under the Securities Act of 1933 (U.S.): Defines the term "accredited investor" and outlines the criteria for accreditation, including income and net worth thresholds. Securities and Exchange Commission (SEC) Rules under Regulation D: Provides further details and interpretations of the accreditation criteria.

Qualified Clients (QC): Rule 205-3 under the Investment Advisers Act of 1940 (U.S.): Defines the term "qualified client" and establishes criteria related to assets under management. Securities and Exchange Commission (SEC) Rules under the Investment Advisers Act of 1940: Offers additional guidance on the definition and criteria for qualified clients.

Qualified Institutional Buyers (QIB): Rule 144A under the Securities Act of 1933 (U.S.): Defines the term "qualified institutional buyer" and establishes criteria for institutional investors to qualify. Securities and Exchange Commission (SEC) Rules under Rule 144A: Provides further details and interpretations of the qualification criteria for QIBs.